News and Views

Supermarket Strategy 2029: Format Innovation and Branding Meets Measurable Return.

Retailers are increasingly shifting away from one-size-fits-all models, designing store formats around clearly defined shopping missions. Ranges, services, and communication are tailored to neighbourhood behaviour and trip intent, ensuring higher relevance and efficiency at local level.

Supermarket Strategy 2029: Driving Measurable ROI with Format Innovation & Strategic Branding.

Retail leaders face escalating cost pressures, fragmented shopping missions, and intensifying competition. By 2029, the winners will be those who transform format strategy, brand systems and technology into predictable commercial performance, not just flashy innovation.

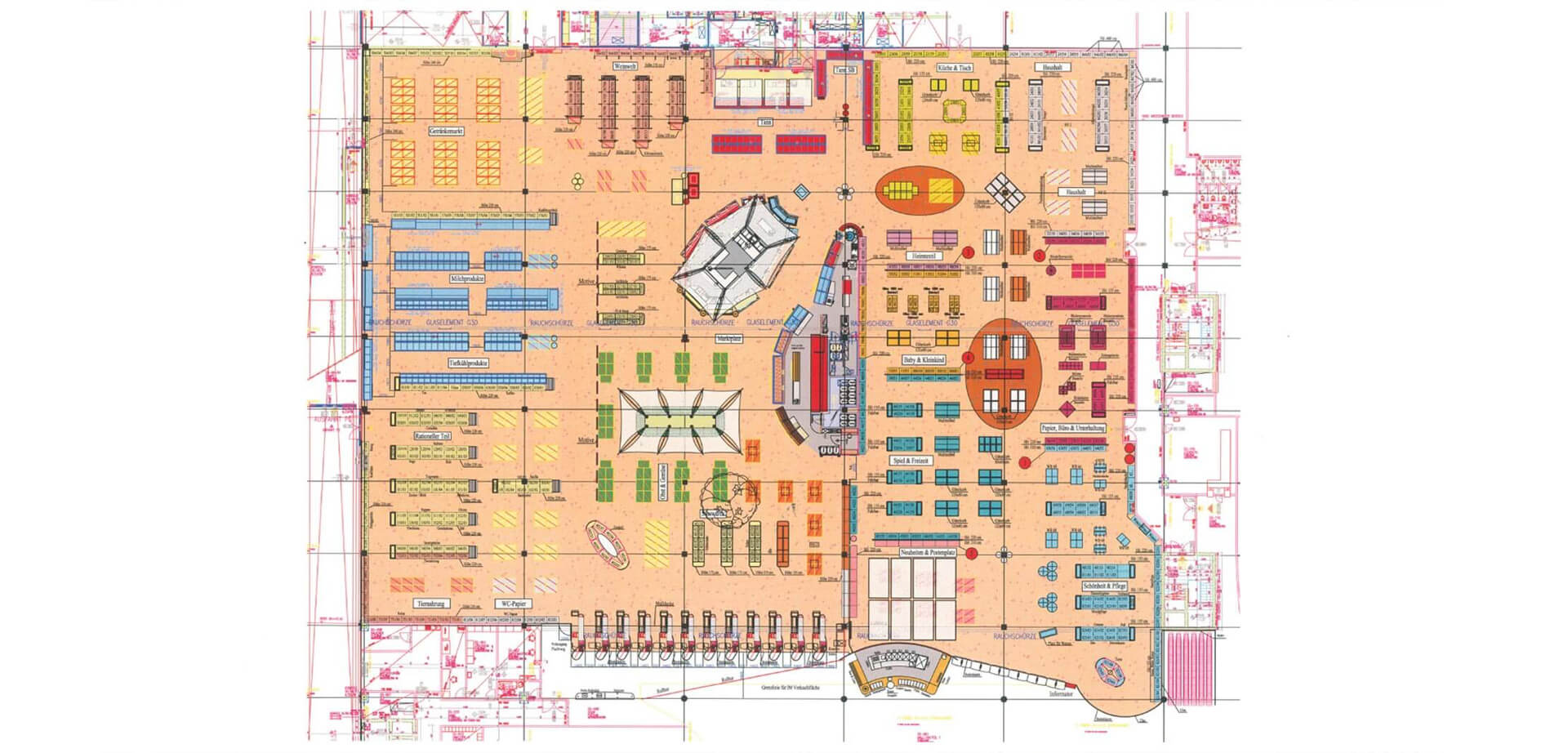

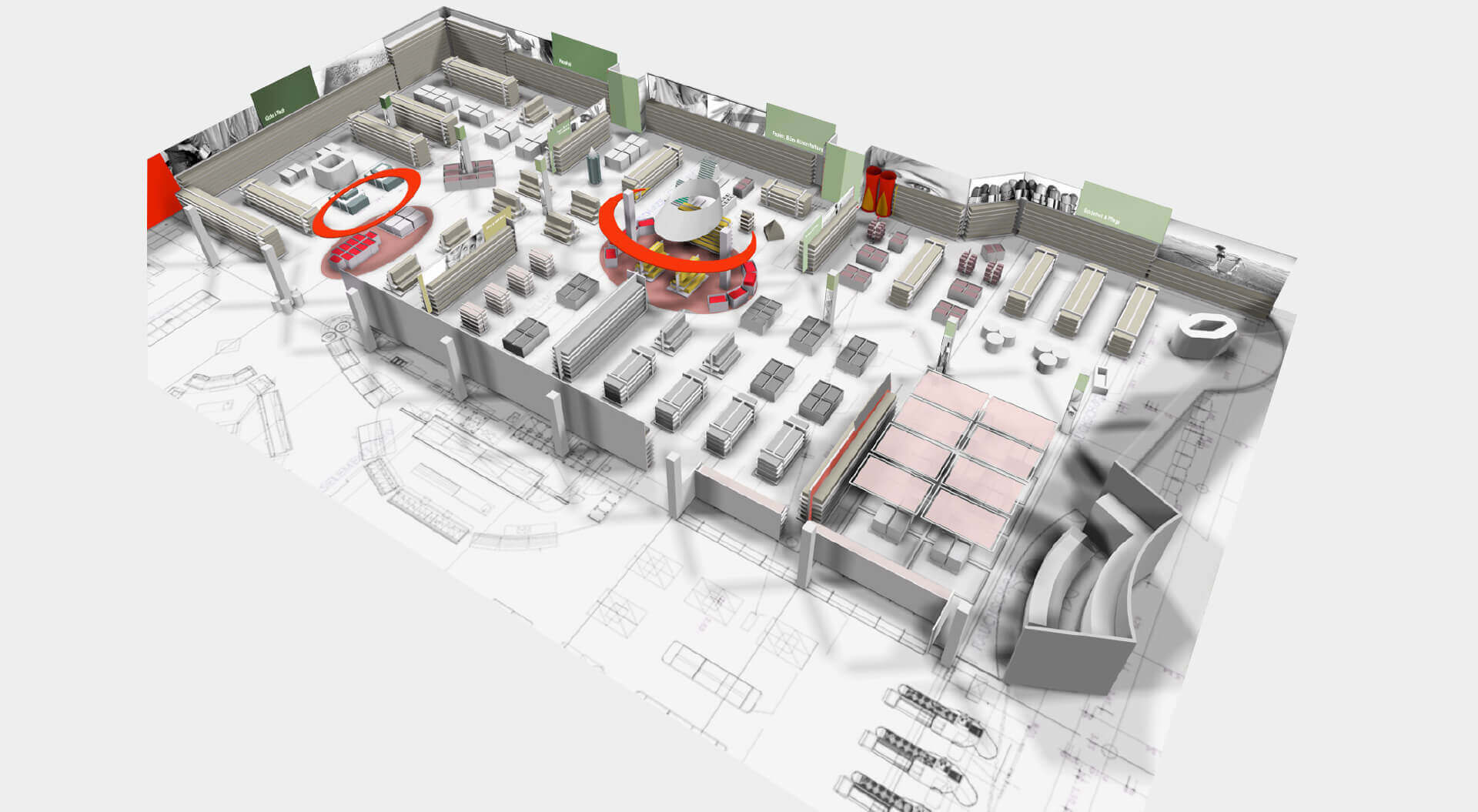

This global approach is informed by benchmarking projects including 7Fresh Supermarkets in China (Agency: Mucca), INTERSPAR Hypermarket in Villach, Austria (Agency: CampbellRigg), and Aldi Supermarket China (Agency: Landini Associates).

Why This Matters Now:

Traditional “one-size-fits-all” supermarket formats are losing relevance. Consumers shop with distinct missions, convenience, fresh food, meal-solutions, and retailers who align brand, layout and tech to these missions unlock better loyalty, higher basket size, and stronger ROIC.

Key Strategic Shifts for 2029:

1. From Standardization to Predictive & Hyper-Local Formats

2. Modern retail performance requires tailoring formats to neighbourhood behavior and trip intent.

3. Predictive AI and modular store layouts help operators plan assortments, reduce waste and increase sales per square metre.

Commercial impacts include:

1. Faster inventory turns

2. Reduced operating cost per transaction

3. Higher sales per square metre

The Problem:

Many supermarket operators continue to deploy high-capex store formats and technology programmes that deliver short-term impact but weak long-term returns. One-off flagships, over-engineered digital layers and rigid formats struggle to scale, diluting ROIC and increasing operational risk.

Capital is often allocated to visible innovation rather than systems that materially improve availability, inventory efficiency, basket composition and performance per square metre. As operating costs rise and margins tighten, this disconnect between investment and commercial outcome increasingly constrains sustainable growth.

The Strategic Solution:

Winning retailers will redirect capital toward scalable systems that consistently improve brand loyalty and performance per square metre across multiple formats. Predictive AI, modular format planning and disciplined brand architecture allow investment to work harder across supermarkets, convenience stores and urban formats. Hyper-localisation increases basket relevance and loyalty without adding complexity, while experience-led design shifts physical retail from fixed cost to incremental revenue generator.

Success depends on tying every investment decision to measurable KPIs, sales uplift, basket size, inventory turns, dwell time and ROIC, across both food and non-food categories.

Capital-efficient retailers will outperform through clarity, not complexity. Predictive infrastructure, adaptable formats and experience-led environments will deliver higher returns with lower risk.

The winning strategy is not fewer stores or more technology, but smarter systems that flex across formats, missions and markets. Retailers that align investment with commercial outcomes, rather than innovation theatre, will generate sustained ROIC, stronger brand loyalty and more resilient portfolios across food and non-food retail.

China Context:

China offers a high-speed view of the same efficiency logic at scale. 7 Fresh represents a next-generation convenience-supermarket hybrid. Small, high-density formats designed for fresh food, ready-to-eat, and rapid fulfilment. Deep integration with JD’s logistics, predictive demand forecasting, and last-mile delivery.

Stores function simultaneously as retail spaces, micro-fulfilment hubs, and data engines

German Context:

Germany represents Europe’s clearest example of efficiency-led grocery retail at scale. The market is shaped by disciplined format design, cost control, and operational precision rather than experiential excess. Discounters such as Aldi, Lidl, and Penny continue to expand compact urban and neighbourhood formats built around curated assortments, fast checkout, and private-label economics, optimised for frequency, speed, and value clarity.

At the same time, REWE, EDEKA, and INTERSPAR are adopting hybrid efficiency models, combining strong fresh propositions with selective frictionless technologies such as self-checkout and scan-and-go. Local ranging and neighbourhood-specific assortments maintain relevance while protecting margin and capital efficiency. The result is a system-driven retail model where price leadership and local relevance are operational outcomes of disciplined format architecture and intelligent execution.

Commercial impact:

1. High sales per square metre

Compact footprints, tight assortments, and high visit frequency drive strong productivity, particularly in urban and neighbourhood formats.

2. Fast inventory turns

Limited SKU counts, strong private-label penetration, and centralised demand planning improve stock efficiency and reduce working capital.

3. Low operating cost per transaction

Self-checkout, simplified layouts, and labour-efficient formats lower cost-to-serve while maintaining service expectations.

4. Strong price perception and loyalty

Clear value positioning, consistent pricing, and local relevance drive trust and repeat visits more effectively than range depth.

5. Improved ROIC through format discipline

Lower capex, repeatable store models, and rapid rollout cycles deliver

CampbellRigg collaborated with Interspar Hypermarkets to develop their Villach store in Austria, integrating brand strategy, store design, and format planning to create a 4,600 sqm, locally relevant, performance-driven compact hypermarket that enhances shopper experience, operational efficiency, and sales per square metre across the network.

Looking ahead to 2027–2029, winning retailers will simplify systems while deepening local relevance. Success will come from tightly connecting predictive technology, format planning, loyalty platforms and brand architecture to measurable outcomes, sales uplift, productivity per square metre and ROIC. The strongest growth will be delivered through adaptability, investment discipline and the ability to translate intelligence into repeatable returns across diverse retail portfolios.

“I am writing to recommend CampbellRigg for business cooperation on creative design solutions in the retail industry." Murat Akdag - Head of Marketing, Migros Ticaret A.S. Turkey

"I am very pleased with the very good job that Campbell and his team have done to help us create our new look, and have no hesitation In recommending CampbellRigg for their excellent work in a very challenging retail environment." Carlos Criado-Perez Chief Executive, Safeway

In China, the same efficiency logic is accelerating at scale. Ultra-efficient hybrid formats prioritise speed, fresh food, and fulfilment over browsing. Retail operates as a system-first model, with inventory, pricing, and labour optimised centrally through AI. Here, brand becomes a trust signal, clear promises around quality, safety, and value replace in-store theatre as the primary driver of loyalty.

Aldi’s China expansion mirrors its European playbook but adapted for urban density:

Highly curated assortments

Strong private-label focus

Digital-first pricing, membership, and app-based engagement

Compact formats positioned for frequent trips rather than weekly shops

Commercial impact:

1. Lower capex per store

2. Rapid breakeven

3. Clear value positioning in highly competitive urban markets

4. China reinforces the same lesson seen in Europe: format efficiency + system intelligence beats size and complexity.

Our Four-Step Process:

1. Book a consultation call for free

2. Co-create a bespoke brief

3. We execute the creative work fast

4. You see sales, brand loyalty and market share uplift

Conclusion: Commercial Impact of Branding Format Efficiency

Across all markets, the commercial impact of branding-led format efficiency is clear and consistent. Mission-led assortments, supported by fresh food and food-to-go propositions, increase basket relevance and incremental spend.

From the UK and Germany to China, the future supermarket is defined by fewer, smarter formats; predictive systems operating invisibly; brand architectures that flex locally without dilution; and convenience stores designed for frequency, not scale.

Ready to Transform Your Supermarket Performance?

Schedule a free consultation with CampbellRigg’s retail branding and design experts to make every square metre work harder.

Cost-Effective Excellence:

Our pricing structure is highly competitive, offering exceptional value without compromising on quality or creativity.

Rapid Execution:

We move fast. From concept to implementation, our agile team ensures your project is delivered on time and to the highest standards.

Multidisciplinary Expertise:

Our team brings together seasoned brand strategists, architects, interior designers, and graphic designers, collaborating to create seamless, end-to-end brand environments.

Global Reach, Local Insight:

With successful projects delivered across Europe, the Middle East, and Asia, we combine international experience with local market understanding.

Scalable Project Delivery:

Whether it's a flagship hypermarket store, an metropolitan city supermarket or convenience store, we manage and execute projects of all sizes, efficiently and effectively.

Proven Track Record:

Our designs evolve branch networks from purely transactional spaces into experiential, relationship-focused brand environments, enhancing engagement, elevating customer experience, and driving tangible business results.

Full-Service Creative Agency:

From rebranding and marketing campaigns to spatial design and rollout, we provide an integrated service tailored to your goals.