Barclays Bank Branding & Branch Design

We build financial brands designed to transform markets.

Innovative. Relevant. Trustworthy.

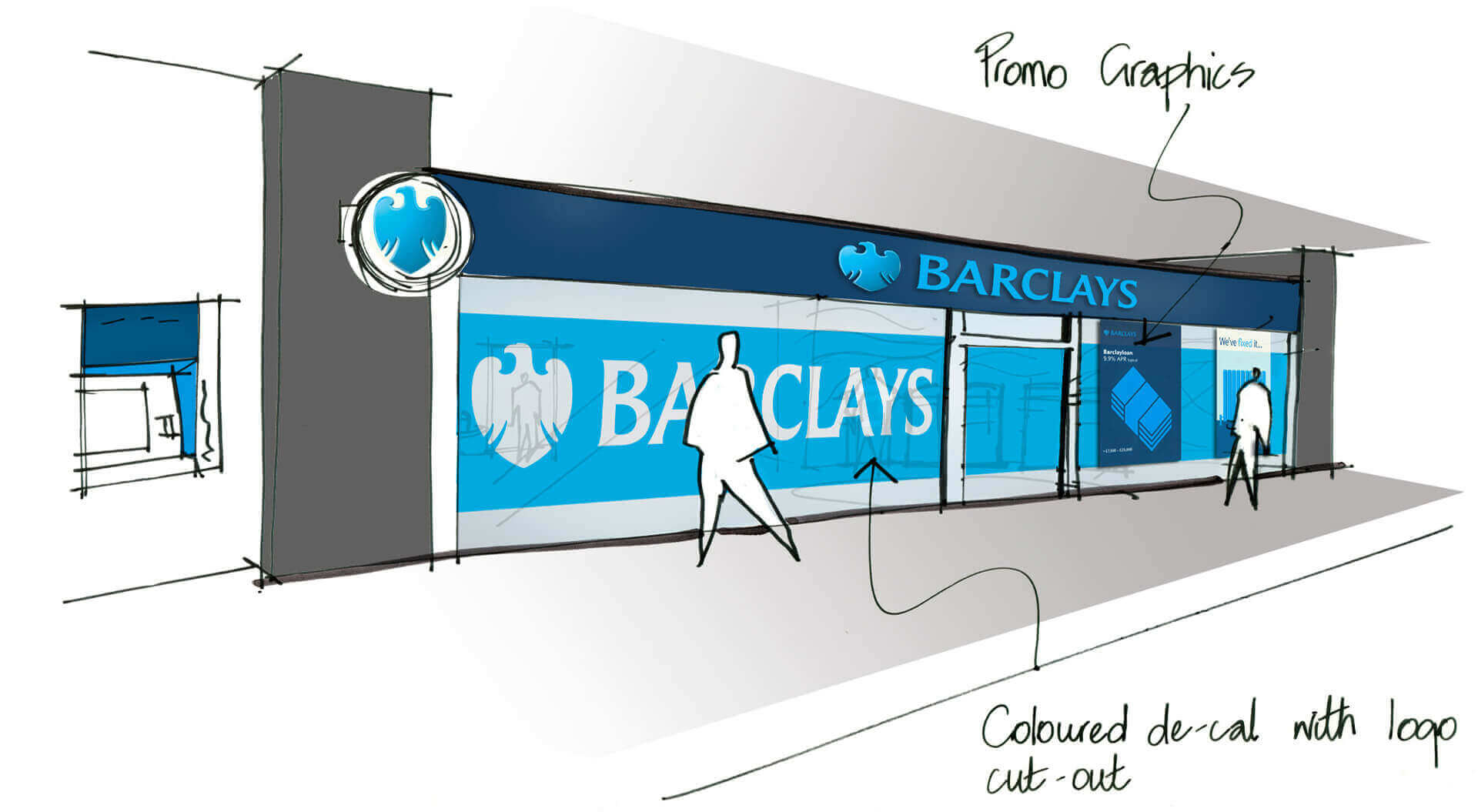

A refresh of one of the world’s most recognized brands with a bank branch audit and recommendations for a sustainable retail platform.

At CampbellRigg, we partner with leading financial institutions to transform traditional branch networks into customer-centred, future-ready retail environments that drive brand relevance and measurable performance outcomes.

Our work with Barclays Bank UK focused on assessing branch operations and recommending a sustainable, insight-driven retail platform.

A multi-channel consumer-centric lifestyle study

for a bank branch transformation programme.

Seeking a sustainable retail platform

for the future.An audit across different brick-and-mortar formats

of Barclays retail branch network. They reassess their branch

footprints and how they will run their branches, moving

forward with digitization and innovation.

Objective: Redefining Retail Banking for Today’s Market

Barclays engaged us during a period of heightened economic uncertainty when banks nationwide are reevaluating branch footprints and customer engagement. Our brief was clear: identify opportunities for immediate improvement and long-term transformation that enhance customer experience while supporting commercial resilience.

Rather than offer cosmetic fixes, we conducted a comprehensive multi-channel audit across Barclays’ branch formats, analysing how customers interact with.

1. Location & positioning within local catchments

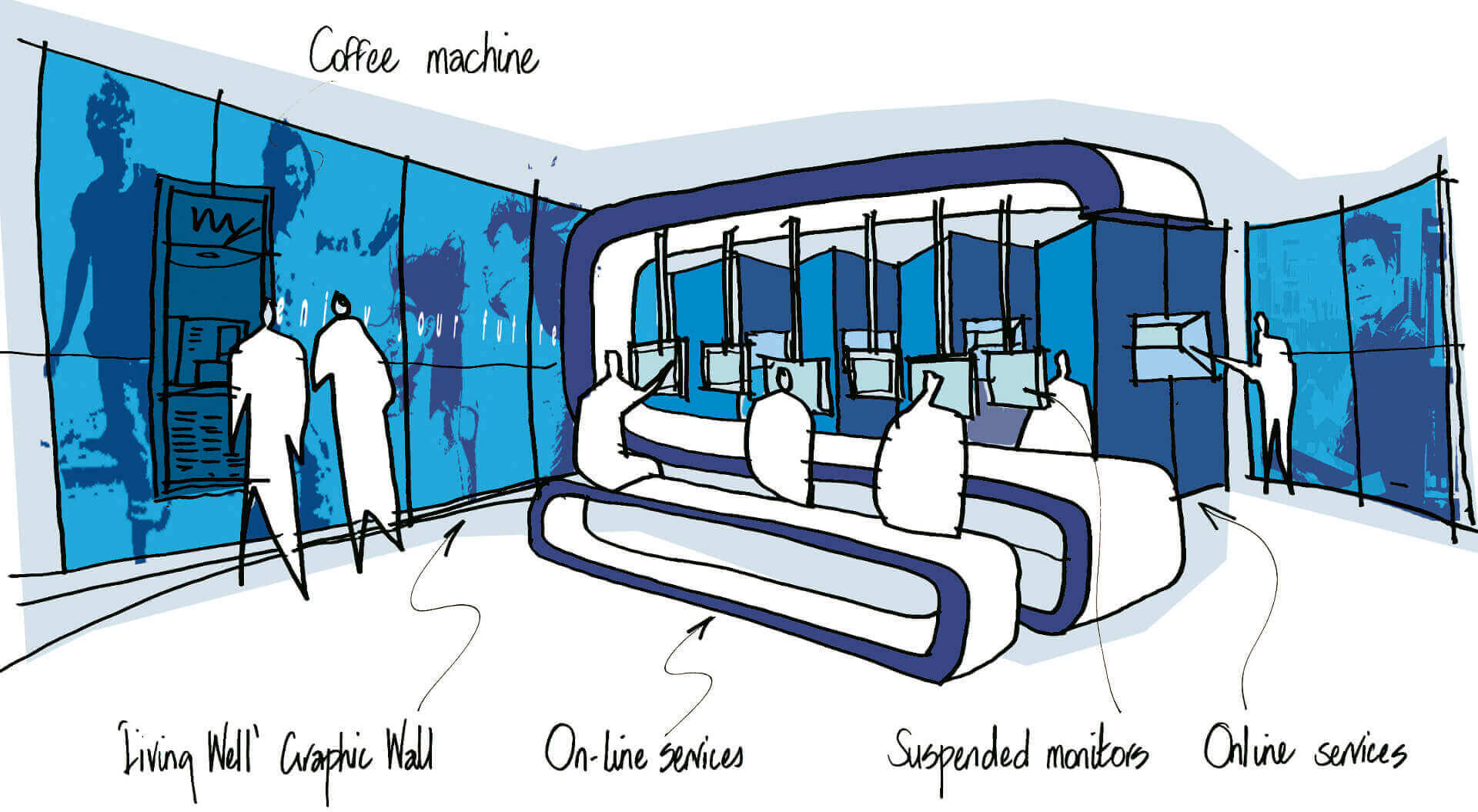

2. Physical environment and circulation

3. Exterior and interior brand communication

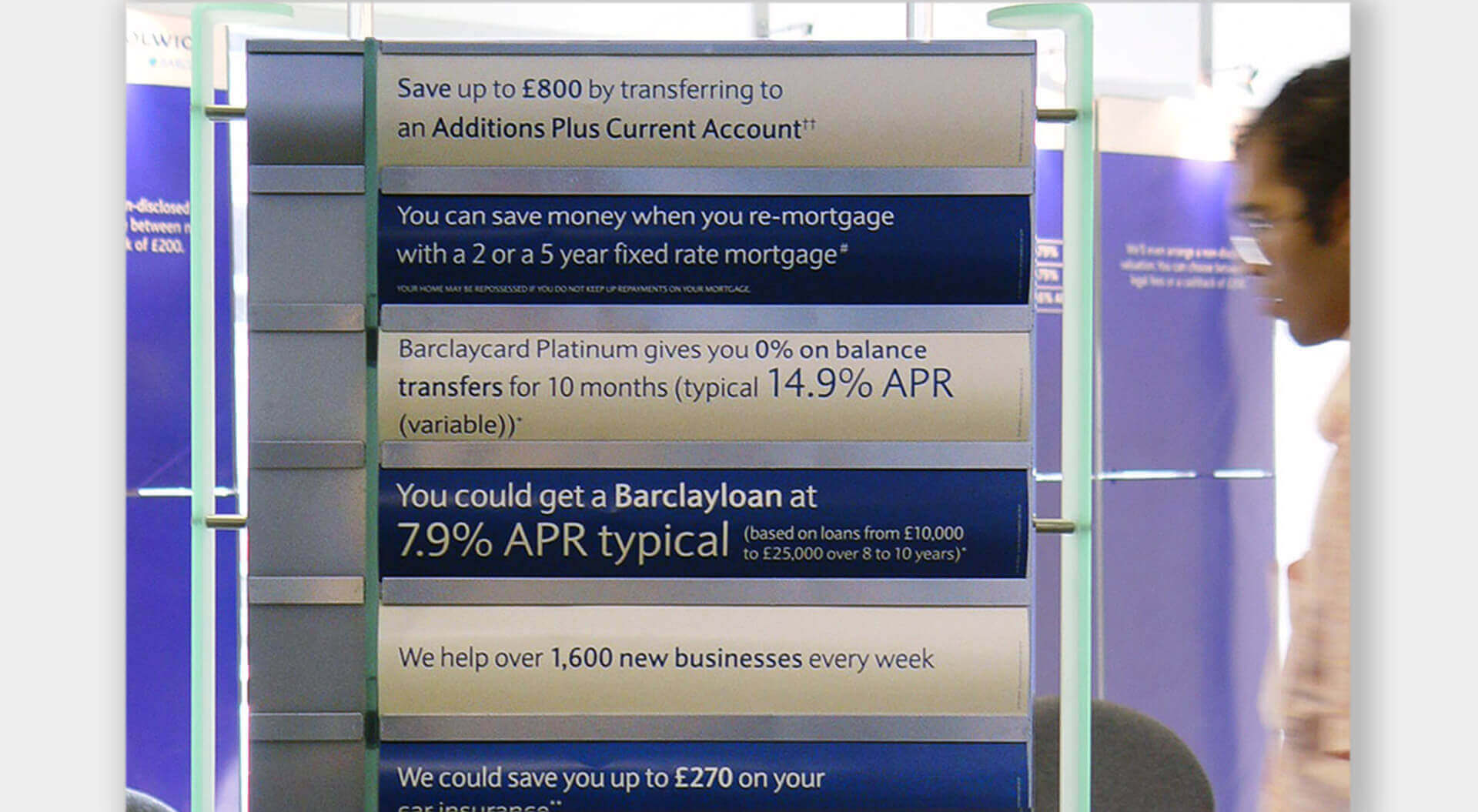

4. Marketing assets and promotional touchpoints

5. Technology and self-service interfaces

6. Operational workflows and staff-customer dynamics

Banks face big risks from shrinking

branch networks. As this process of

retail rethinking continues, against a backdrop

of tougher times for consumers, businesses

and financial institutions, there is one

encouraging point for

financial marketers.We help improve the impact of branding, interior design,

branch planning, self-service areas, cross-selling opportunities,

and digital marketing.

Our review looked beyond aesthetics, it evaluated customer behaviours, competitor benchmarks, and real-world usage patterns to identify practical, phased steps toward improved performance.

Strategic Recommendations: From Insight to Action

1. Phased Retail Platform Transformation - We recommended a layered implementation strategy, balancing quick wins (e.g., enhanced signage and wayfinding) with longer-term infrastructure improvements to reduce cost and disruption.

2. Customer Behaviour Integration - Recommendations were grounded in how customers shop financial services, including journey times, service expectations, and digital adoption patterns, ensuring each branch redesign aligns with real usage, not assumptions.

3. Brand-Led Environment Enhancements - We emphasised brand warmth and relevance alongside functionality, ensuring Barclays’ physical spaces communicate trust, clarity and purpose, critical attributes in retail banking.

Commercial Value & Retail Impact. Our audit provided a practical roadmap for Barclays to:

1. Prioritise branch layout changes with the highest ROI potential

2. Align signage and messaging to customer needs

3. Improve cross-selling and service uptake through better behavioural cues

4. Plan technology upgrades that support service efficiency

5. Implement changes in cost-effective phases

In an era where branch networks are under pressure, our insights helped Barclays focus investment where it matters most, enhancing customer experience while protecting operational budget.

Why This Matters:

Banks face the dual challenge of rising digital adoption and evolving customer expectations. Retail environments that are intuitive, branded and strategically planned become competitive assets, shaping loyalty, increasing dwell time and supporting advisory services beyond transactional banking.

CampbellRigg specialises in retail banking strategy, branch experience design, format planning and communications that help financial institutions balance digital innovation with physical presence.

Book a strategy consultation or download the Barclays branch transformation summary to uncover how design and insight can elevate your network’s performance.