News and Views

By 2029, capital efficiency and hyper-local branding will be the defining metric of supermarket success.

A CEO-level framework for aligning format planning, technology and brand architecture to predictable returns and portfolio resilience. (Projects attributed to: Loblaws - In-House Team, Longo's Market - Ampersand, and Victoria Supermarkets - CampbellRigg)

Investment & Brand Efficiency Strategies

Predictive AI will become the invisible infrastructure of retail, fundamentally improving inventory turns, reducing waste and stabilising margins across food and non-food, without adding operational complexity to each category. At the same time, hyper-local format branding will drive greater basket relevance and loyalty at store level, unlocking consistently higher performance per square metre. As these systems mature, experience-led environments will convert physical retail into a monetised platform, driving structured growth across foodservice, ervices and adjacent growth categories.

Crucially, capital should migrate away from bespoke flagship projects toward scalable, modular systems that flex across food, homewares and textiles. Retailers that align format planning, loyalty ecosystems and brand architecture to ROIC-led decision-making will outperform peers. The strongest investment cases will come from businesses that treat technology as invisible infrastructure, brand as a commercial multiplier, and experience as a disciplined growth lever, delivering predictable uplift rather than speculative innovation.

Below: The image shows the interior of Loblaws Food Market, focusing on natural foods.

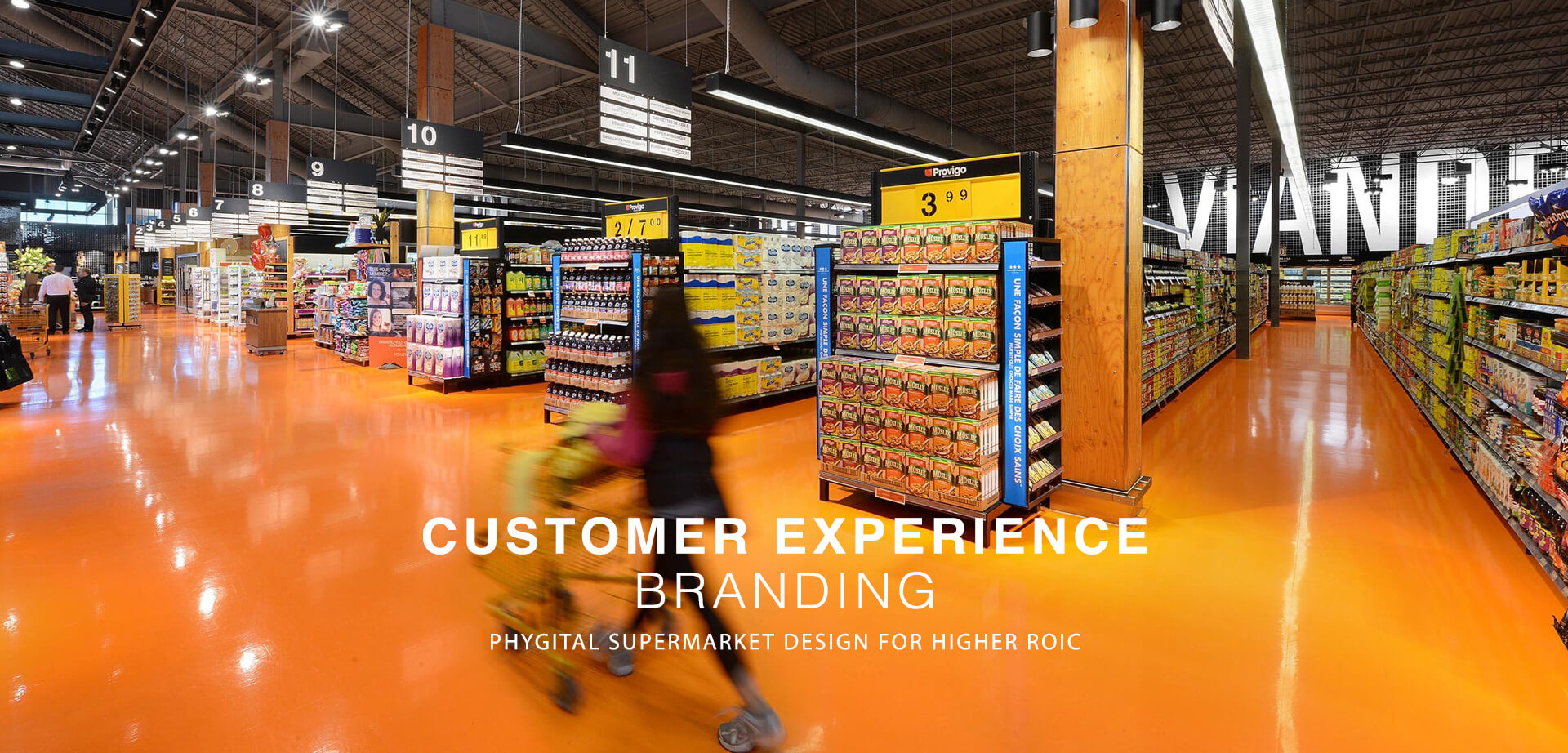

The interior view of a Provigo Le Marché grocery store in Quebec, Canada. Provigo is a member of the Loblaw group, Canada's largest food retailer.

The Problem:

Many supermarket operators continue to deploy high-capex store formats and technology programmes that deliver short-term impact but weak long-term returns. One-off flagships, over-engineered digital layers and rigid formats often fail to scale, diluting ROIC and increasing operational risk. Capital is frequently allocated to visible innovation rather than systems that improve availability, inventory efficiency and basket performance. As costs rise and margins tighten, this misalignment between investment and commercial outcome constrains sustainable growth.

The Strategic Solution:

The next phase of retail will be defined by a decisive shift toward scalable systems that consistently raise performance per square metre. Predictive AI, modular format planning and disciplined brand architecture will become non-negotiable, allowing capital to work harder across multiple store formats. Hyper-localised branding will increase basket relevance and loyalty without adding complexity, while experience-led design will move from cost centre to incremental revenue generator. Success will be determined by the ability to tie every investment decision to measurable outcomes, brand loyalty, sales uplift, basket size, inventory turns and ROIC, across both food and non-food retail.

The observation that highly standardised supermarket formats no longer reflect fragmented consumer behaviour is especially relevant in the Canadian market and has increasingly shaped Loblaws’ strategic direction. Rising cost-of-living pressures, strong regional identities, and differing urban–suburban shopping missions have pushed Loblaws to move beyond a uniform national model toward a more flexible, locally responsive retail strategy.

Loblaws’ Response and Strategic Shift:

Loblaws has progressively adapted its approach to balance scale efficiency with regional relevance. Rather than relying on rigid standardisation, the group is evolving toward an omnichannel, multi-format strategy that responds to local demographics, price sensitivity and shopping behaviour, while maintaining strong brand trust and operational discipline.

Diversified Store Formats:

Loblaws operates a wide portfolio of store formats tailored to distinct missions and catchments. These include large-format Loblaws and Real Canadian Superstore locations for full weekly shops, value-led No Frills stores for price-focused consumers, and urban or neighbourhood formats such as CityMarket and Your Independent Grocer, which prioritise convenience, fresh food and local relevance. This format diversity allows Loblaws to flex its offer by geography, income profile and trip type across Canada.

Value and Quality Focus:

Loblaws’ strategy is anchored in a clear value–quality spectrum. At one end, No Name and No Frills reinforce price leadership and everyday value. At the other, President’s Choice, PC Black Label and curated fresh and prepared food ranges support quality perception and margin stability. This dual focus enables Loblaws to serve cost-conscious shoppers while still appealing to customers seeking quality, trust and inspiration, particularly in fresh, private label and ready-to-eat categories.

Longo's, a Canadian grocery chain, showcasing its fresh produce department above and prepared meals section branded as "The Kitchen: Fresh meals, made easy" below.

Experience & Local Relevance:

Phygital retail will evolve into an experience defined by ease, relevance and emotional confidence. Invisible AI will quietly orchestrate frictionless journeys, ensuring availability, personalised value and seamless checkout without drawing attention to the technology itself. Physical environments will increasingly act as trust-building spaces, using hospitality-led zones, fresh food theatres and locally resonant storytelling as seen in brands like Loblaws City Markets and Longo’s Market.

Loblaws City Market

Why it fits: As Canada’s largest grocer, Loblaws operates a multi-banner, multi-format network, from No Frills to City Market, tailored to local needs. PC Optimum loyalty, PC Express and broad private-label ranges reinforce national scale with local relevance.

KPI impact: Strong loyalty engagement and repeat purchasing drive higher wallet share and sales per square metre. Format diversity supports resilient same-store performance across value and urban segments.

Emotional relevance + trust: Local assortments, private-label innovation and rewards-led engagement build trust and emotional connection nationwide.

Longo’s Markets

Why it fits: Longo’s is a premium, community-focused grocer in Southern Ontario, combining fresh, locally sourced food with experience-led store environments across large and urban formats.

KPI impact: A focus on fresh, local and differentiated ranges supports higher average baskets, premium margins and strong loyalty. Investment in e-commerce and supply chain improves availability and efficiency.

Experiential relevance + trust: Strong in-store experience and community heritage position Longo’s among Canada’s most trusted food retailers.

Longo's store designs often incorporate features like in-store bakery, kitchens with ready-to-eat meals, salad bars, and various premium services, reflecting a focus on the customer experience.

Conclusion:

Looking ahead to 2027–2029, winning retailers will simplify systems while deepening local relevance. Success will come from tightly connecting predictive technology, format planning, loyalty platforms and brand architecture to measurable outcomes, sales uplift, productivity per square metre and ROIC. The strongest growth will be delivered through adaptability, investment discipline and the ability to translate intelligence into repeatable returns across diverse retail portfolios."The next-generation supermarket is not defined by geography, but by its ability to translate intelligence into relevance and relevance into return."

Our Four-Step Process:

1. Book a consultation call for free

2. Co-create a bespoke brief

3. We execute the creative work fast

4. You see sales, brand loyalty and market share uplift

CampbellRigg partners with Victoria Supermarkets in Russia to align brand strategy, store design and format planning, creating locally relevant, performance-driven supermarkets that improve shopper experience, operational efficiency and performance per square metre across the estate.

For Victoria Supermarkets’ rebranding, we created a modern, refreshed brand identity accompanied by a complete brand toolkit.

"CampbellRigg helped develop a new creative concept for our retail network branding in Russia, including the master brand and two store format sub-brands. We appreciated their support and efficiency throughout the process and are pleased with the successful implementation of the concept." Oleg Kunkov, Director General, Victoria Group

Schedule your consultation today and receive a free quote.

Cost-Effective Excellence:

Our pricing structure is highly competitive, offering exceptional value without compromising on quality or creativity.

Rapid Execution:

We move fast. From concept to implementation, our agile team ensures your project is delivered on time and to the highest standards.

Multidisciplinary Expertise:

Our team brings together seasoned brand strategists, architects, interior designers, and graphic designers, collaborating to create seamless, end-to-end brand environments.

Global Reach, Local Insight:

With successful projects delivered across Europe, the Middle East, and Asia, we combine international experience with local market understanding.

Scalable Project Delivery:

Whether it's a flagship hypermarket store, an metropolitan city supermarket or convenience store, we manage and execute projects of all sizes, efficiently and effectively.

Proven Track Record:

Our designs evolve branch networks from purely transactional spaces into experiential, relationship-focused brand environments, enhancing engagement, elevating customer experience, and driving tangible business results.

Full-Service Creative Agency:

From rebranding and marketing campaigns to spatial design and rollout, we provide an integrated service tailored to your goals.