News and Views

Why the bank branch of the future will look nothing like the bank of yesterday - Umpqua.

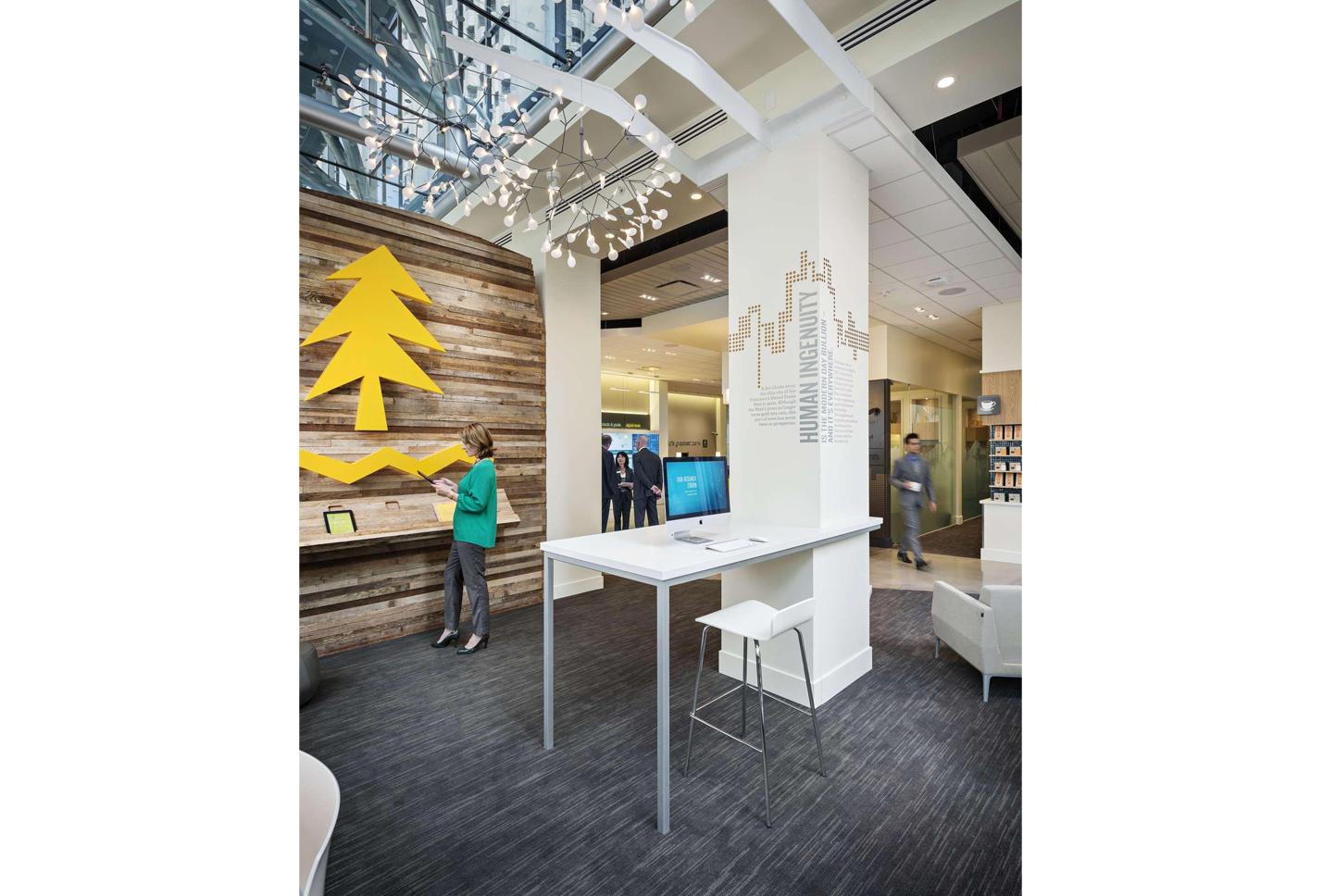

Umpqua Bank Portland Oregon

Walk into some bank branches today, and you might feel as though you've stepped into a Capital One café, where traditional teller stations and cash handling facilities have been replaced with more casual, customer-centric spaces.

At Umpqua Bank in Portland, Oregon, branches have transformed into vibrant community hubs. Visitors can attend yoga classes, surf the internet, and enjoy organic coffee, all while being surrounded by t-shirt-clad employees who encourage customers to linger. This "branch-as-community-hub" concept reflects a shift toward relationship-building and brand engagement rather than purely transactional banking.As the focus moves increasingly toward customer experience, bank branches have shrunk in size and adopted a more personal approach. Customers still value face-to-face interactions, especially when discussing personal financial matters. According to Campbell Rigg, it’s about having these conversations on the customer’s terms with brand ambassadors rather than traditional bank tellers.

The Branch of the Future

Welcome to the bank branch of the future, where branches aren’t just places for transactions but are evolving into spaces for financial advice and consultation. We believe this transformation is just beginning, as banks work to meet customers where they are, both in-person and online. In some cases, banks have rebranded tellers as “relationship managers,” guiding customers through tasks like using smart ATMs, depositing checks via smartphones, or securing loans and investments.

Welcome to the bank branch of the future, where branches aren’t just places for transactions but are evolving into spaces for financial advice and consultation. We believe this transformation is just beginning, as banks work to meet customers where they are, both in-person and online. In some cases, banks have rebranded tellers as “relationship managers,” guiding customers through tasks like using smart ATMs, depositing checks via smartphones, or securing loans and investments.

The Tech Giant Threat

Banks are facing growing competition from unrelated industries. In China, e-commerce giants like Alibaba and JD.com have entered the financial services sector, offering cashless retail and banking solutions through apps such as Alipay. These companies aren't necessarily interested in traditional banking but are drawn to the valuable consumer data they can collect by tracking spending patterns.Given the rise of digital-only banks like Monzo, Chime, and Starling Bank, some question the necessity of physical branches. Many customers now handle banking tasks via ATMs or apply for loans through video calls. However, analysts say that the branch isn't disappearing; it's becoming more digitally focused, with employees acting as financial advisors rather than transactional tellers. This begs the question: Should bank branches resemble community hubs or doctor's offices?

Banks are facing growing competition from unrelated industries. In China, e-commerce giants like Alibaba and JD.com have entered the financial services sector, offering cashless retail and banking solutions through apps such as Alipay. These companies aren't necessarily interested in traditional banking but are drawn to the valuable consumer data they can collect by tracking spending patterns.Given the rise of digital-only banks like Monzo, Chime, and Starling Bank, some question the necessity of physical branches. Many customers now handle banking tasks via ATMs or apply for loans through video calls. However, analysts say that the branch isn't disappearing; it's becoming more digitally focused, with employees acting as financial advisors rather than transactional tellers. This begs the question: Should bank branches resemble community hubs or doctor's offices?

Adapting to Changing Customer Behavior

With cash usage declining and transactions becoming increasingly automated, the need for branch visits has diminished. However, older, affluent customers and small business owners still prefer the human touch when dealing with complex financial issues. Even Generation Y appreciates face-to-face consultations for matters such as loan applications or problem resolution."Consumers want a friendly face to discuss their banking concerns," says Campbell Rigg. This is why Royal Bank of Scotland has halted further branch closures after reducing its network by 573 branches, concluding that their 800-branch network is "about the right size" to meet customer needs.The goal is to remove barriers for customers, enabling them to have meaningful financial conversations that go beyond simple transactions. Banks are blending traditional services with digital technology, offering interactive walls, smart ATMs, and iPads showcasing new products and services.

With cash usage declining and transactions becoming increasingly automated, the need for branch visits has diminished. However, older, affluent customers and small business owners still prefer the human touch when dealing with complex financial issues. Even Generation Y appreciates face-to-face consultations for matters such as loan applications or problem resolution."Consumers want a friendly face to discuss their banking concerns," says Campbell Rigg. This is why Royal Bank of Scotland has halted further branch closures after reducing its network by 573 branches, concluding that their 800-branch network is "about the right size" to meet customer needs.The goal is to remove barriers for customers, enabling them to have meaningful financial conversations that go beyond simple transactions. Banks are blending traditional services with digital technology, offering interactive walls, smart ATMs, and iPads showcasing new products and services.

The Umpqua Model and Beyond

As customer behaviour continues to evolve, banks are reconsidering their branch formats. The Umpqua Bank model, where branches offer flexible environments with the latest interactive technology and personalised service, is becoming more common in urban areas.In Malaysia, DBS Bank has introduced small-format branches that reflect this trend. These branches have no internal teller transactions—only secure ATMs in the lobby. Inside, customers can enjoy coffee, surf the internet, and consult with brand ambassadors. This blend of casual, customer-focused environments and digital integration could be a template for the future of branch design.

As customer behaviour continues to evolve, banks are reconsidering their branch formats. The Umpqua Bank model, where branches offer flexible environments with the latest interactive technology and personalised service, is becoming more common in urban areas.In Malaysia, DBS Bank has introduced small-format branches that reflect this trend. These branches have no internal teller transactions—only secure ATMs in the lobby. Inside, customers can enjoy coffee, surf the internet, and consult with brand ambassadors. This blend of casual, customer-focused environments and digital integration could be a template for the future of branch design.

A Role for Branches in a Digital World

While digital banking is on the rise, there is still strong demand for in-person banking. For many banks, branches remain a crucial sales channel. The personal touch, especially for complex financial decisions, keeps customers coming back to physical locations, even as they embrace digital services.Our ongoing research allows us to continually benchmark and analyse best-in-class branding and design across global markets. The images in this article, sourced from Capital One, Umpqua Bank, Royal Bank of Scotland, and DBS Bank, illustrate the evolving nature of bank branches.

While digital banking is on the rise, there is still strong demand for in-person banking. For many banks, branches remain a crucial sales channel. The personal touch, especially for complex financial decisions, keeps customers coming back to physical locations, even as they embrace digital services.Our ongoing research allows us to continually benchmark and analyse best-in-class branding and design across global markets. The images in this article, sourced from Capital One, Umpqua Bank, Royal Bank of Scotland, and DBS Bank, illustrate the evolving nature of bank branches.

Take a moment to explore other news items linked to this page, and feel free to reach out to us to discuss your brand, design, or digital and social media needs.